3 important steps to improve your company’s financial health

A main ally in difficult times is the bank. Having a good relationship with the bank, and above all being sure that your bank is the best option among the offer, is very important. But… what can banks bring us in the short term? We tell you all about it below: Your banks and how to shield the liquidity of your business.

Your banking entities and how to shield the liquidity of your business.

If you have not already done so, check with your bank (and other banks to compare conditions) for the following points:

Obtain a credit card for your business.

For most day-to-day expenses, you can pay with your credit card by delaying these payments for 30 days on your cash flow. Depending on the credit rating of your business, you will get different limits for the cards, so analyze well the different options offered by each bank and choose the one that offers you the best conditions. And remember, always pay your credit card balances on time to avoid penalties and a worsening of your credit rating.

2. Open a savings account with good interest

If you are in a position where you can afford to have your business set aside money on a regular basis, look for a good savings account that will give you the best interest rates on the money your business saves.

3. Do you need a line of credit?

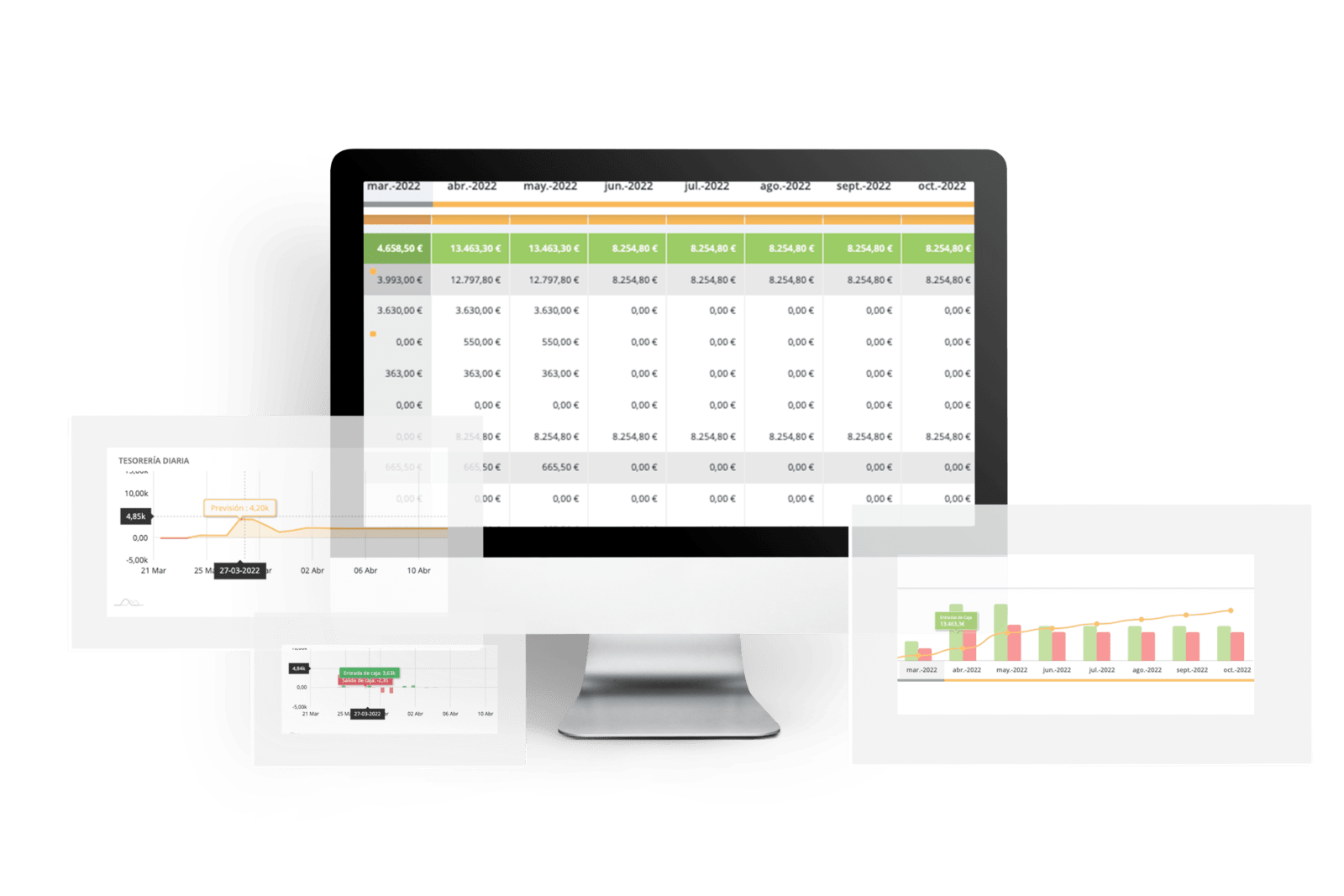

Be adequately prepared. With a cash flow plan in place you will be able to visualize when your business will need a cash injection to continue operations, and how much the line of credit will need to be to survive the next few months. In addition, when knocking on the door of banks, you will need to make a case for your future creditworthiness, and a long-term cash flow forecast can provide sufficient information to secure financing for which you may be eligible. Always remember to ask for an amount with sufficient margin to be able to continue responding to unforeseen events that you have not yet been able to contemplate.

Your banking institutions and how to protect your business liquidity

Do you know if you will need financing in the next 12 months? How much exactly? And at what point? Don’t wait for surprises, create your forecasts and keep the reins of your business knowing well what will happen with your future cash flow.

Don’t know where to start? A good starting point is to talk to one of our experts to explain how Orama can help you.