Data management within a company is essential to know its status. We always hear about the importance of automating processes. Cash flow, and its control, is not left behind, that is why we want to discuss treasury management software as the best option.

But how can we apply cash flow automation to our company?

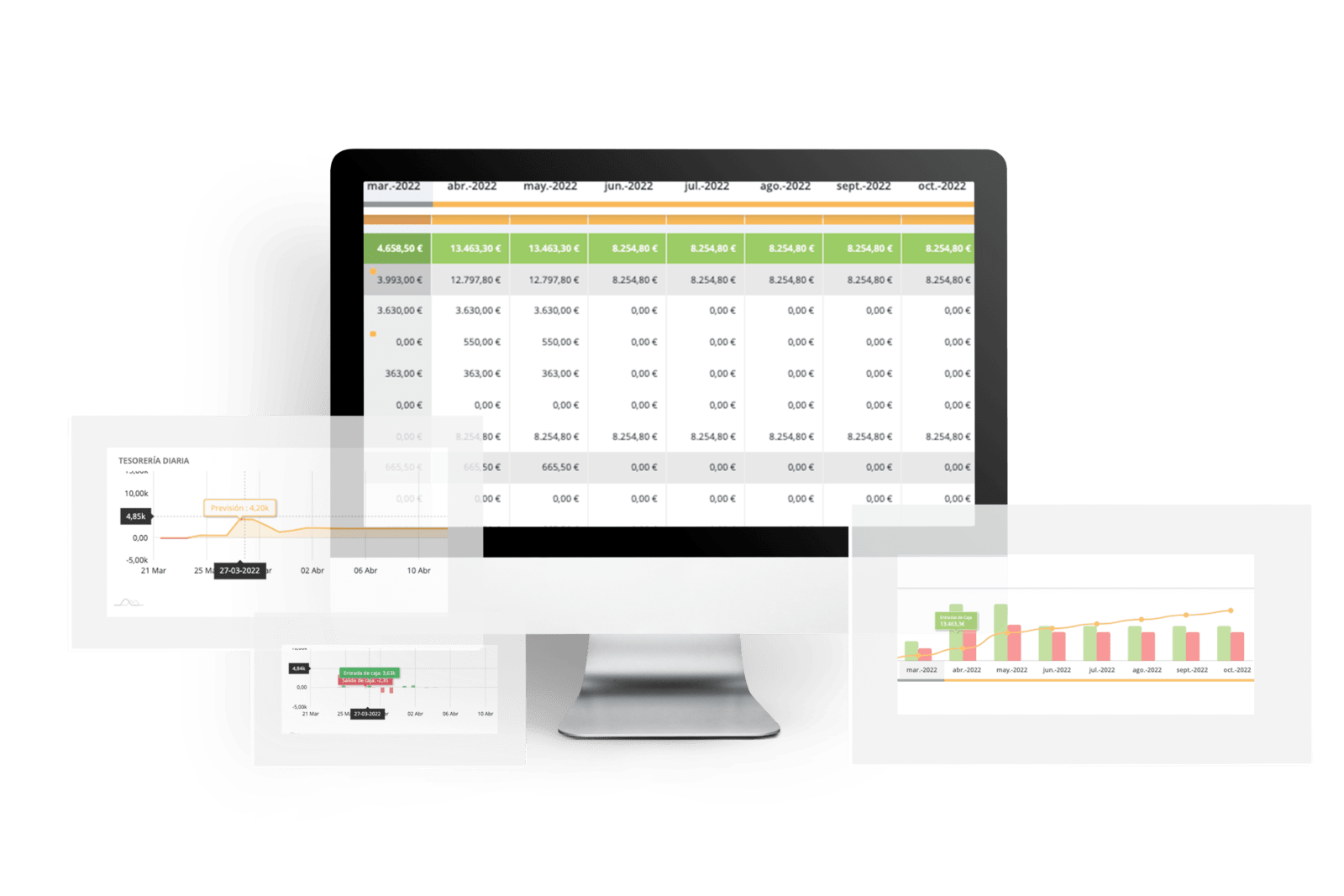

The innovations that have taken place over the last few years have allowed the creation of software that help companies to manage their data without the need for a lot of knowledge or specific techniques. This progress can be seen reflected in how companies manage their finances today, accompanied by a SaaS such as Orama.What is treasury management software?

A SaaS is a software as a service and in this case focused on treasury management. It is a support for the finance department that allows you to save time by automating processes and shows you the most relevant data of your treasury at the moment. It also allows the finance department, by automating these repetitive processes, to focus on other areas of the company’s finances.Why manage your treasury with software?

Companies that have already implemented this type of software have noticed an improvement in process efficiency and productivity. One of the key points of these software solutions is that they adapt to the financial needs of different sizes of companies. It is especially relevant for cash flow forecasting, financial planning, coordinating payments, uncollected debts, or non-payments to public bodies due to lack of coordination. This undoubtedly provides a competitive advantage over other companies in the sector that may not optimize their time efficiently.The revolution in treasury management

Until now, companies managed their treasury manually on an Excel sheet, which can result in human error due to lack of organization and time or simply lack of data coordination. There are other companies that use their own digital management systems, which may be stuck in old technologies or company parameters. Upgrading this type of system or creating a new one is a very high investment and has few advantages today. The functionalities of a software like Orama are fully adaptable and upgradeable. Orama is a user friendly tool, which means that no extensive technological and financial knowledge is required to be used. The sections that can be explored in it are based on a language known within the financial sector and department, so it is easy to know its sections. It has a system similar to the use that can be given to Excel, the most used tool in this sector. This type of design allows it to be quickly incorporated into the modus operandi of the finance department of any company.Treasury management software, allows:

- Track cash flow.

- View bank transactions in real time.

- Create alerts when a specific movement or financial situation is detected.

- Analyze updated data.

- Short-, medium- and long-term forecasts

- Adaptation to your company’s operation

- Obtain customer support

Try Orama with no commitment

Save time and errors!

Guided onboarding

No credit card required

Cancel anytime