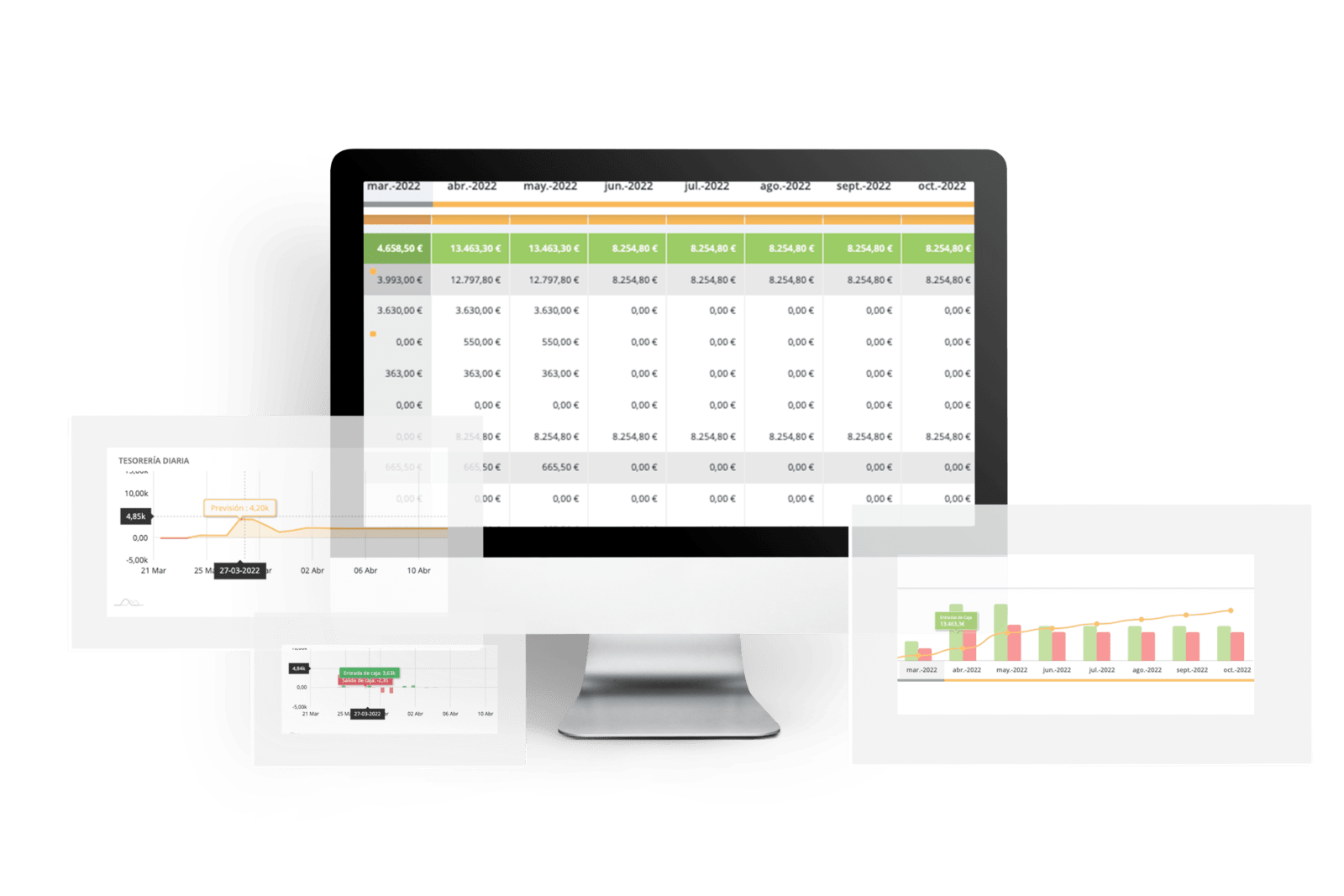

Learn how to use the balance sheet: financing strategy. The balance sheet is one of the three financial statements. As its name indicates, it explains how a company is doing at a specific moment in time. In other words (and in a more informal way), it is an accounting “snapshot” of a company.

This document can give us a lot of information, for example, it can help us to estimate the cash requirements. But, before we get to that point, let’s review its elements.

HOW THE BALANCE SHEET IS STRUCTURED

The balance sheet consists of the assets, i.e., what the company owns and needs to operate; and the liabilities and equity, which tells us how the company is financing its assets. Therefore, the balance sheet reflects the financial structure of the company.

Assets are divided into current and non-current assets. Current assets are assets that are needed to operate and need to be financed. Although they have used cash to be generated, they are not generating cash from the normal rhythm of our business operations.

For example, inventory: in other words, all the products in the warehouse that we have paid for and that do not generate cash until we sell them and collect payment. But these are costing you the box, as they are in storage. Therefore, they do not add up and, in addition, they take away.

In these cases in which assets increase, they must be compensated elsewhere: either assets decrease (with cash outflows) and equity and liabilities remain the same; or the sources of financing of equity and liabilities increase.

BOX: WHAT IS IT FOR?

- Finance a fixed asset: in the early stages of development and in expansion phases.

- Finance NFO: i.e., finance its operations and, consequently, growth.

- Cover business losses until it becomes profitable. This is one of the main objectives of the box in startups without profits and with barely validated revenue model.

- Pay dividends to its partners: this is typical of companies that are already consolidated, profitable and growing.

NFO: NEED OF FUNDS

The operating needs for funds (NOF) is the money necessary to carry out our activity (current assets). We take them into account when we plan in the short term our operating capacity to be profitable. We find it in the balance sheet.

The NFOtells us how much investment in working capital (i.e., cash and immediately liquid assets) your company needs to cover operating expenses and develop the activity. Therefore, in order to know the current assets and liabilities, we have to analyze our cycle or average maturity period.

There are two phases that are linked to the product maturation cycle: the stock phase (i.e. from the purchase of the goods to their sale) and the collection phase (from the sale to the collection from the customer). Therefore: we have to take into account the costs to be financed until the company starts to generate operating cash flow.

HOW IT IS CALCULATED

NFO = [Tesorería operativa] + Inventories + Accounts Receivable (customers) – Accounts Payable.

As cash or operating cash is difficult to calculate, we can set it as a value of 0 to have a more accurate calculation.

When it is positive, it indicates that the asset is to be financed. That is why it is important for a company to also look at how to finance its operations and optimize its NOF.

However, NFO´s can also be negative. When does this happen? If we pay our suppliers late and collect from our customers early (or even in advance), they finance our operations. NOFs can finance our investments in fixed assets that we need to expand the business. In other words, having a negative NOF means that your customers are financing your growth (or assets).

Schedule your demo with one of our specialists and see how Orama can help you with your balance sheet.