Learn how to calculate cash flow, as it is an essential tool for good financial health. Would you like to know how to calculate cash flow? We explain everything below.

WHAT IS CASH FLOW?

First of all, it should be clarified that cash flow is a financial term that refers to the cash inflows and outflows that occur in a company in a given period. It is a key tool for calculating the company’s financial status, as it indicates how much cash the company has.

In other words, if we have a negative cash flow it means that the company does not have sufficient liquidity to meet its debts. On the other hand, if we have a positive cash flow, it means that we have liquidity.

WHY IS CASH FLOW IMPORTANT?

Drawing up a cash flow is key, since, if we project it properly, we will be able to foresee when we are going to run out of liquidity. In the event that we see that in a few months we are going to break even, we will have to reduce expenses .

In addition, it will not only help us to take corrective measures, but also to plan our finances. If we know that we have X months of cash left (i.e., we have X

runway

of X), we can start planning a financing round with time and, consequently, without losing decision-making power (since we will not be in a hurry to have this money).

LEARN HOW TO CALCULATE CASH FLOW

As mentioned above, this tool is measured on the basis of the inputs and outputs that occur within a period (which is why we can analyze its operation in detail).

Therefore, the cash flow has a very simple calculation: it is the sum of income and all expenses are subtracted from it . However, the potential of this tool lies in the breakdown that we can make.

TYPES OF CASH FLOWS

We can separate the cash flow into 3 different views: in this way we can understand which of the company’s revenues and which of its expenses are the result of operations, investment or financing, respectively.

OPERATING CASH FLOW

The operating cash flow (or operating cash flow) comes from the ordinary income related to the direct activity of the company. That is, day-to-day revenues and costs. To exemplify income, it would be mainly sales. On the expense side, these would be the costs associated with the company’s economic activity.

INVESTMENT CASH FLOW

In this case, the investment cash flow records the cash inflows and outflows related to the development of the company in terms of growth . To calculate it would be to add up all the income generated by investments, subtracting those made to improve a process.

CFI is normally negative, as the company usually invests in the growth of the company.

CASH FLOW FROM FINANCING

Finally, we have the financingcash flow, which comes from the activities that change the business’s equity capital and the debts assumed. In other words, the difference between cash inflows and outflows related to the financing of the company.

In this case, the CFF is usually positive, since the money comes in from the financing received.

Once we have these cash flows calculated, we can clearly see the financial health of the company, foresee liquidity problems, and even analyze the viability of investments. In short, it is a key financial indicator to know in what financial state your company is in.

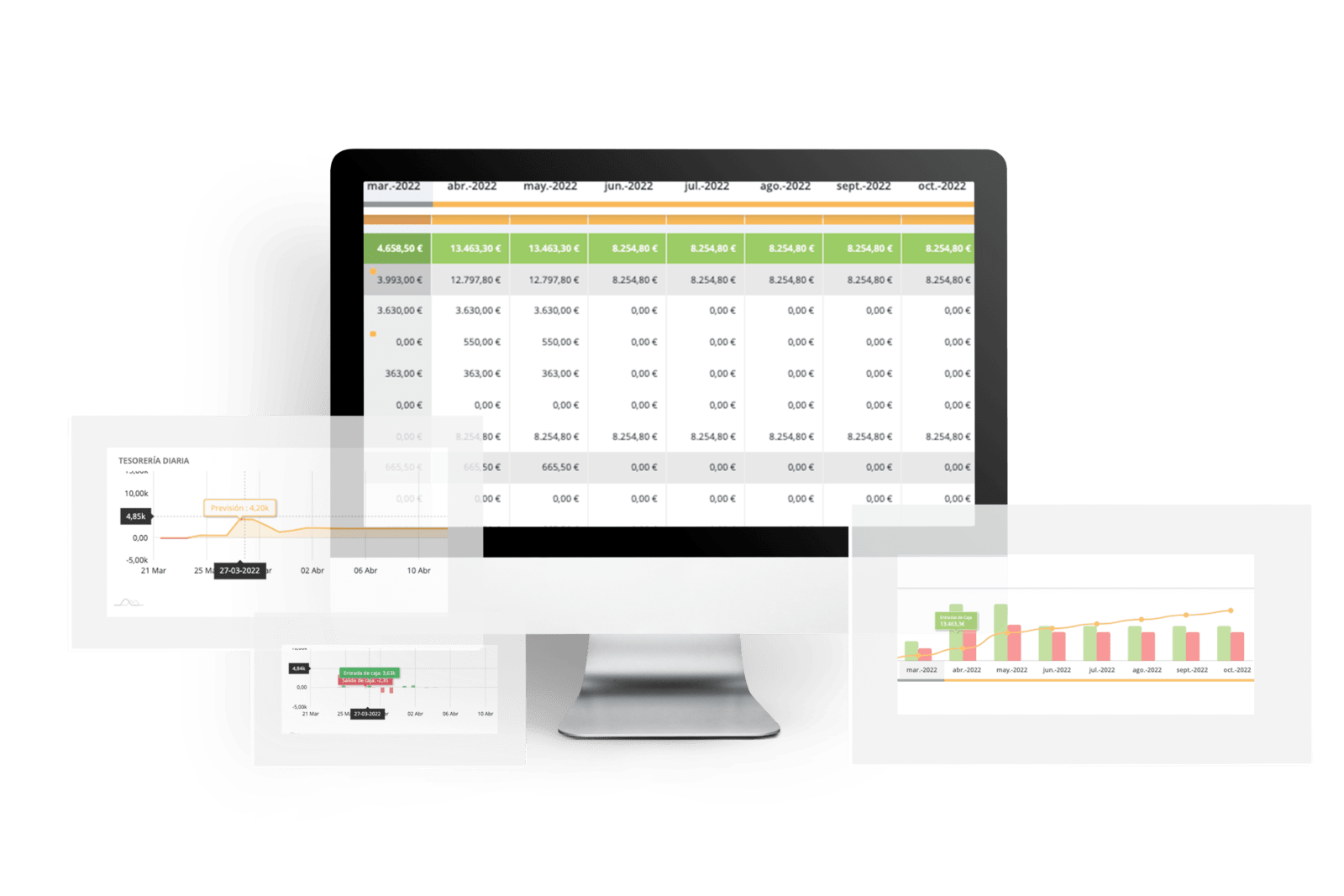

With the creation of scenarios and twelve-month forecasts with Oramayou will be able to to foresee possible liquidity problems before they occur. Likewise, you will always have up-to-date cash flow by performing the automatic bank reconciliation, thus avoiding possible errors derived from manual work in the Excel cash flow plan.